ACCRALAW acted as legal counsel to the Joint Lead Underwriters and Bookrunners, BDO Capital & Investment Corporation, China Bank Capital Corporation, BPI Capital Corporation, East West Banking Corporation, First Metro Investment Corporation, Land Bank of the Philippines, and SB Capital Investment Corporation in connection with SM Prime Holdings, Inc.’s (“SM Prime”) shelf registration of Debt Securities amounting to One Hundred Billion Pesos (PhP100,000,000,000.00) with an initial offering of up to Twenty Billion Pesos (PhP20,000,000,000.00) Fixed Rate Bonds and an oversubscription option of up to Five Billion Pesos (PhP5,000,000,000.00) consisting of 3-year Series V Bonds, due on 2027, 5-year Series W Bonds, due on 2029, and 7-year Series X Bonds, due on 2031. The bonds were issued through the Philippine Depository & Trust Corp. and listed with the Philippine Dealing & Exchange Corp. on 24 June 2024.

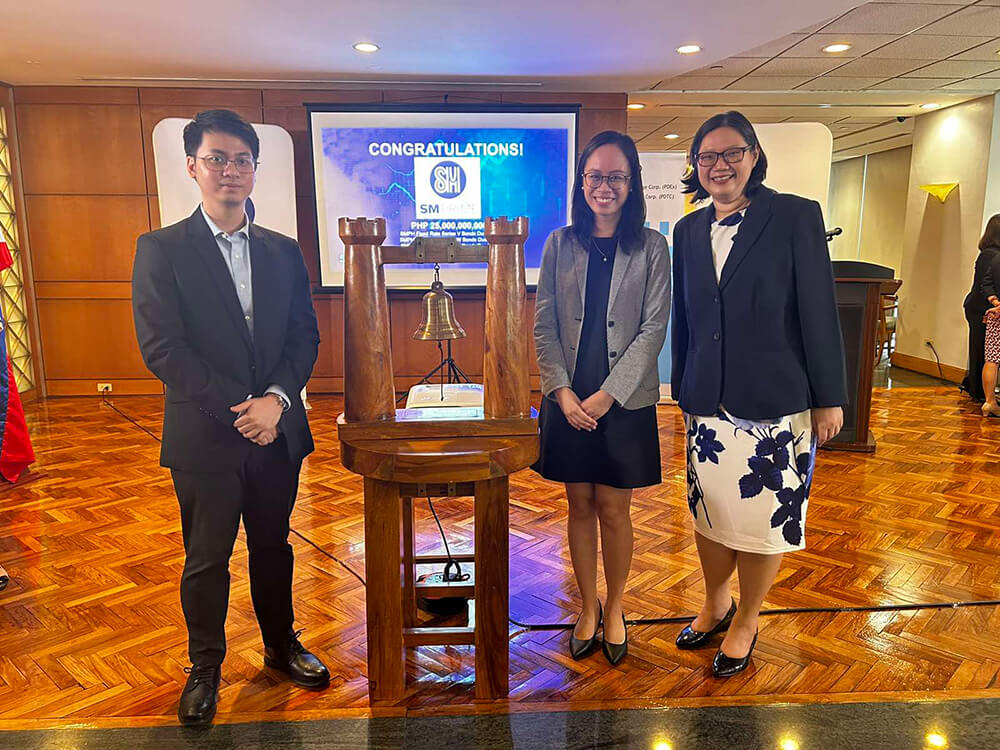

The Firm’s lawyers from the Corporate and Special Projects Department, namely Partner Everlene O. Lee, Senior Associate Celerina Rose D. Fajardo-Nacin, and Associates Christine Joy S. Escalante and Eric Leonardo L. Cembrano worked on the project. Senior Legal Counsel Francisco Ed. Lim also assisted the team.